20 April 2021

Vietnam

In Vietnam, the share of women in the labor force is high and estimated at 73%. Around 71% of working women are self-employed, mostly in agriculture and in the service sectors. The opportunities for women to earn a good income while performing dual roles as earners and family caregivers are still limited. Also, access to financial services (both loans and saving products) remains challenging for women. One of the objectives of the GREAT program is to support women in agriculture value chains in Vietnam to improve their access to finance and the market.

As part of the GREAT program, Financial Access designed and developed a capacity training for loan officers from LienVietPostBank (“LVPB”). The objective of the training was to create more awareness for potential gender-sensitive issues in agrilending as well as to support the business case design for lending to female smallholders. During the training, we discussed several ideas to embed a gender lens in the implementation of LVPB’s strategy throughout the loan cycle. For instance, the importance of appropriate financial products, non-financial services (like training on financial literacy and engagement with the Credit Union), as well as alternative delivery channels were discussed.

The GREAT partnership fits well with the Financial Access strategy to reduce the large gap between the supply and demand in smallholder finance through in-depth individual cash flow-based credit profiling and by connecting smallholder farmers in agri supply chains in a scalable manner to affordable, formal finance. Vietnam, with its large rural population and financially underserved agricultural sector, is a key focus country for Financial Access. The GREAT program offers us the opportunity to expand our activities in Vietnam and to deepen our impact in smallholder finance in Southeast Asia.

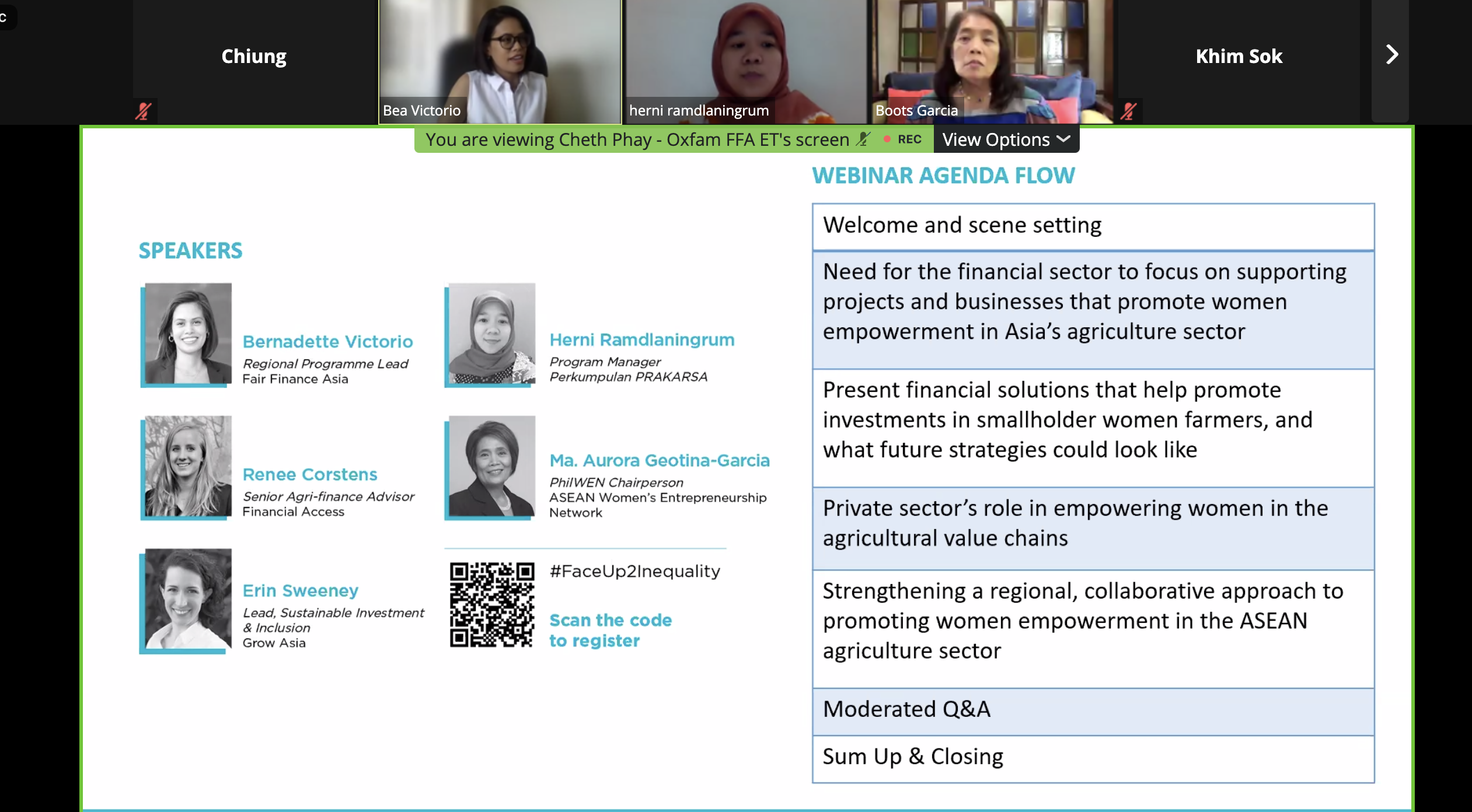

Furthermore, Financial Access was invited by GrowAsia to speak at its webinar about Banking on Women’s Empowerment in the ASEAN agri sector. We presented several financial solutions to help promote investment in to smallholder women farmers in Southeast Asia.

We believe that the GREAT program and the webinar are excellent initiatives that help to address the challenges to promote responsible financing in ASEAN’s smallholder agriculture sector.